Summer 2025 Energy Market Report

Keeping track of what’s happening in the energy market isn’t easy, especially when conditions can change quickly due to supply pressures, global events, and shifting demand. This report provides a clear overview of key developments this summer and what they could mean as we head toward the colder months.

Key Developments: Summer 2025

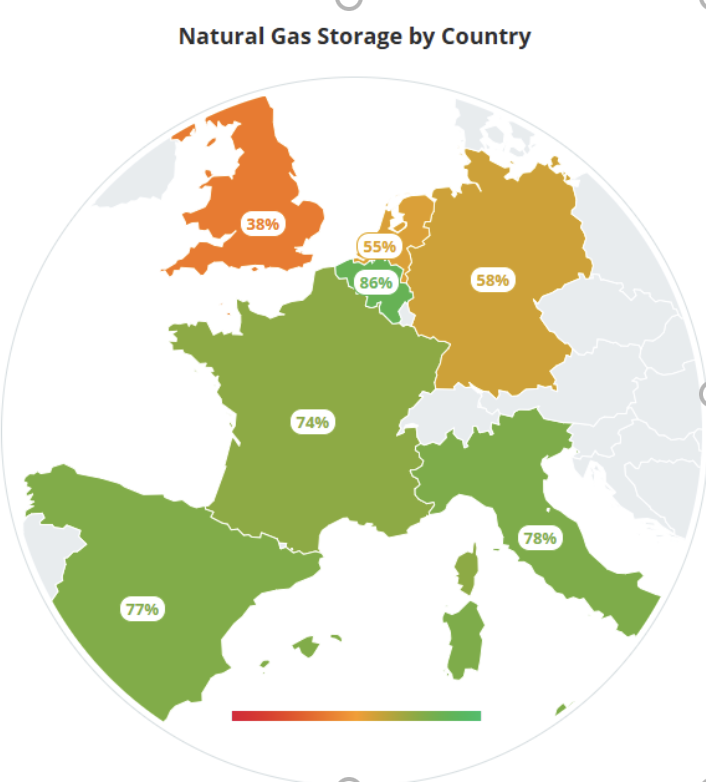

1. UK Gas Storage Running Below Average

As of late July, UK gas storage levels are at 38%, falling short of the five-year seasonal average of 75%. While this isn’t yet cause for alarm, it raises concerns for the months ahead. Lower reserves going into winter can increase the risk of price spikes, especially during periods of high demand or if unexpected supply issues emerge.

2. Global Events Trigger Price Sensitivity

The international energy market remains highly reactive to geopolitical developments. A recent shift in diplomatic positioning related to the Russia–Ukraine conflict sent gas and power prices higher across Europe. These movements highlight the continued volatility and how quickly market sentiment can shift.

3. New Supplier Activity and Market Innovation

Since the energy crisis of 2021–2023, a growing number of new suppliers have entered the market. Many are offering competitive rates, flexible contract structures, and greener energy options. These developments are introducing more choice and opportunity for those reviewing their energy strategy.

Market Indicators: Pricing Trends

Gas Prices Climb After Early Summer Lull

The start of July was relatively calm, but gas prices began to climb again toward the end of the month:

- August 2025 UK NBP gas: ↑ from 75.85p to 77.07p per therm

- Winter 2025 delivery: ↑ from 86.14p to 87.09p per therm

Key drivers:

- Political tensions: Uncertainty around Russian supply triggered short-term buying

- LNG supply: Deliveries to Europe are down 13% compared to seasonal averages

- Gas storage: Below-average levels are putting upward pressure on pricing

Electricity Prices Following Gas Movement

Electricity prices have risen alongside gas:

- Front-month UK power: Up nearly 2% over the past week

- Q4-25 baseload power: Now priced at £102.69/MWh (up from £101.58/MWh)

- A recent dip in UK wind output has further tightened power supply, contributing to the rise.

Carbon and Renewables

- UK carbon prices have increased slightly, closing the gap with EU carbon costs

- Strong French nuclear generation has helped support European exports, but this has only partially offset constraints within the UK market

Looking Ahead: What to Watch

- Market softening appears to have paused, with both gas and power prices creeping upward

- Winter conditions remain a key unknown — low storage levels and international volatility could increase pricing risk

- New contract options are emerging, including flexible and sustainability-linked deals that offer alternatives to traditional fixed pricing

Final Thought

With energy markets showing early signs of tightening and uncertainty on the horizon, it may be a good time for businesses to review their upcoming contract dates and procurement strategies. Even a simple comparison of current offers or a review of contract terms can help ensure preparedness ahead of Q4 and into 2026.

For those considering a more proactive approach, testing the market and exploring a wider supplier pool may reveal unexpected value—especially as newer entrants continue to challenge traditional pricing models.

Take Action

Would you like to understand what rates your business could access today—or explore some of the new supplier options?

We’re happy to provide a free, no-obligation review of the market and highlight opportunities tailored to your energy needs.

Get My Energy Options – Contact